Pooled Employer 401(k) Plan (SRS-PEP)

Have you heard about the Successful Retirement Solutions Pooled

Employer 401(k) Plan (SRS-PEP)?

Do you offer a 401k plan? Has it been awhile since you reviewed it with your employees? If you don’t offer a 401k plan are you aware of the new law requiring your company to do so?

Successful Retirement Solutions offers a Multiple Employer 401(k) plan called SRS-PEP. The Successful Retirement Solutions Multiple Employer 401(k) Plan is exclusive to Clients. The SRS-PEP is a retirement plan solution for businesses with 2-500 employees.

By participating in the SRS-PEP, small businesses can offer all the benefits a large company can at a competitive price. The new legislation, in the form of the “SECURE Act” provides for the creation of a new retirement vehicle called a “Pooled Employer Plan” (“PEP”), in which unrelated employers may participate and have their 401(k) plans treated as a single retirement plan.

Save money by joining the SRS-PEP. Employers who participate in the SRS-PEP

give their employees access to the same low-cost investment funds that

large employers can offer. Take advantage of the tremendous tax savings and tax credits employers receive that offer a 401(k) to their employees. Avoid

taking on the costs and administrative challenges of establishing a standalone retirement plan.

You may also qualify for a tax credit(s). There are two ways to qualify. 1. The New automatic enrollment tax credit. The automatic enrollment tax credit is $500 per year for up to three years and is separate from any eligible startup tax credit. Credit is available for an eligible automatic contribution arrangement in a qualified plan SEP or SIMPLE. 2.The Start-up cost tax credit. The start-up credit is 50% of your ordinary and necessary eligible start-up costs up to a maximum of $5000 per year.

What is the SRS-PEP

The Successful Retirement Solutions Pooled Employer 401(k) Plan or (SRS-PEP) is 401(k) plan is exclusive to Southern California Clients.

What is a PEP?

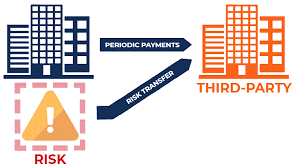

PEP is short for Pooled Employer 401(k) Plan. A PEP is a robust turnkey plan with low cost, monitoring and selection of investments. A PEP allows business to transfer the fiduciary risks to a third party and allows small businesses to be part of a 401(k) that is similar to a Fortune 500 company’s 401(k)

What are the benefits of a PEP vs. a stand-alone plan?

A PEP creates operational efficiencies in administering a 401(k) plan. In addition, you transfer the fiduciary responsibilities to a third party and is more cost effective for most companies.

How much will this cost me and how does that compare to a stand-alone plan?

The cost varies per employer based on the number of employees, but it is safe to say, it is usually a 30% cost savings from a stand-alone plan. (Newport Group)

What would my tax credits be? Let’s do the math for a small employer:

A small business has 15 employees that are eligible 15*$250 = $3,750. —> Max tax credit. The new plan start-up cost $4,500. 50% of the start- up cost is $2,250 —> The cap of the start-up costs eligible for tax credit. Add on automatic enrollment to the plan for another credit: +$500 Total: $4,500 – $2,250 – $500 = $1,750 (62% off!) And don’t forget, claim this TAX CREDIT for the first three years of the plan!

Both qualified startup costs tax credit and automatic enrollment tax credit are general business credits subject to the rules of Code Section 38(B).

Understanding the Successful Retirement Solutions Pooled Employer 401(k) Plan – Recorded Webinar

New legislation and regulations that went into effect December 31, 2020 will allow for pooled employer 401K plans that will result in cost savings for most businesses. In today’s current environment businesses are looking for ways to save money and offer valuable retirement benefits with fewer resources.

This complimentary webinar explains how the federal SECURE Act has changed the way 401(k) will be offered, how businesses can shift fiduciary, administrative, record-keeping responsibility, and reduce risk to their business.

Click below to launch webinar

Play Video

Copyright © 2020. All Rights Reserved.